This acquisition will accelerate the development of this service.Ĭredit Karma SVP and GM Poulomi Damany said, “Credit Karma Money was built to change consumers’ relationship with money and help them develop responsible financial habits, like staying on top of their bills and spending within their means.

The duo claims this partnership helped members increase their credit scores by an average of 21 points in 30 to 45 days. By reporting these payments to the credit bureaus, members took steps toward improving their financial health. This enabled clients to make regular payments, starting from $20 per month or $10 per paycheck.

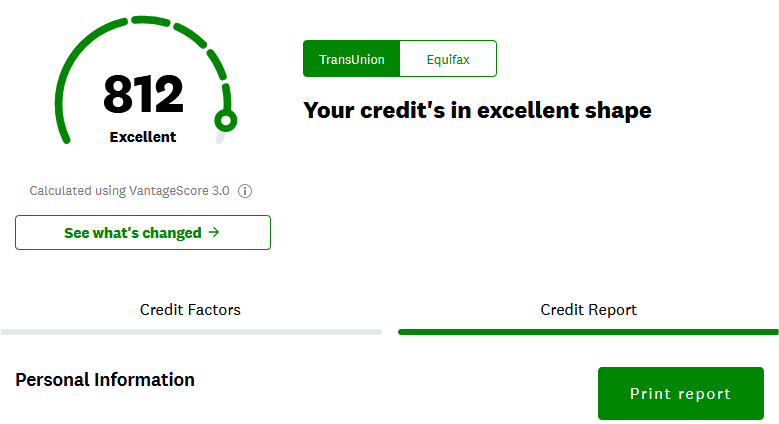

Late last year, Credit Karma entered a partnership with SeedFi to offer Credit Builder to its members. It offers a line of credit and a secured savings account enabling members to build their credit while building up savings.īy combining SeedFi’s Credit Builder technology, with Credit Karma’s relationships with credit bureaus and others in the credit ecosystem, Intuit hopes to move with greater speed and scale to help Credit Karma members make financial progress. The Credit Builder solution helps low, or no-credit borrowers build credit while saving money.

#CREDIT KARMA VS TURBOTAX CREDIT SCORE SOFTWARE#

Intuit is the global technology platform behind tax software TurboTax, accounting tool QuickBooks, email automaton service Mailchimp, personal finance app mint and credit scoring service Credit Karma.

Intuit, a developer of multiple leading FinTech services, has acquired SeedFi, which is the partner behind Credit Karma’s Credit Builder solution.

0 kommentar(er)

0 kommentar(er)