Multiple listing service (MLS) inventory has bounced from the historic low reached at the end of 2021. Sales volume will not stabilize until the market has worked through the presently undeclared double-dip recession and jobs begin to return consistently, expected to take shape in Sacramento around 2025.Īgents and brokers: recession-proof your life Not so in Sacramento, where construction is welcome and typically allows sales volume to keep pace with homebuyer demand.Įven so, home sales are expected to continue their slowdown heading into 2023, primarily due to higher interest rates and the loss of homebuyer enthusiasm. In California’s expensive and desirable coastal cities, new construction has been held back significantly by outdated zoning laws and not-in-my-backyard (NIMBY) advocates. One reason is the consistent addition to the for-sale inventory, in the form of residential construction. Home sales volume in Sacramento has not been as volatile as many other parts of the state. Thus far in 2023, sales volume year-to-date is a steeper 34% below a year earlier and 36% below 2019. Compared to the last “normal” year for home sales, 2022’s home sales volume total was 19% below 2019. However, sales volume quickly reversed in 2022, totaling 22% fewer sales than a year earlier in Sacramento. While a larger increase than prior years, all of California’s other major metros experienced much larger year-over-year leaps in sales volume during 2021, with the sales volume increasing 22% statewide. After years of essentially flat sales volume, home sales volume in 2021 totaled 6% higher than a year earlier. Sacramento County home sales volume has avoided much of the volatility of California’s other major metros. Get to know Sacramento’s local housing fundamentals in the charts that follow.

Home sales won’t begin a consistent recovery until around 2026-2027.

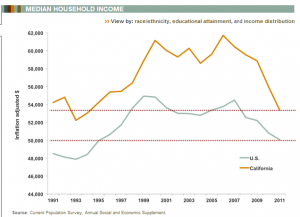

Real estate’s next recession is here, and the time is now for real estate agents to recession-proof their careers. In 2023, Sacramento County will continue to see sales volume and prices decline, worsened by 2023’s deteriorating economic situation. In 2022, home prices began to fall back, having met resistance from rising interest rates and buyer caution. But unlike the last recovery, jobs in this region returned more quickly than other parts of the state, likely due to its reliance on government funding, which was abundant during the hangover from the 2020 recession. This recovery was quickly followed by the 2020 recession, resulting in significant job losses and a complete erasure of the past five years of job gains. Its lagging recovery can be attributed partially to Sacramento’s dependence on state and local government jobs, which were slow to return. This region was one of the last counties in California to reach a jobs recovery from the 2008 recession, necessary to fuel wallets and in turn household formations. Sacramento County, encompassing California’s capital and cities like Elk Grove, Citrus Heights and Folsom, is home to the California Department of Real Estate (DRE).

0 kommentar(er)

0 kommentar(er)